Trending

When the glass ceiling won’t break

A TRD analysis of the city’s top real estate firms finds an eye-opening gender gap

If ever there was a time to talk about sex and gender issues in New York City real estate, it’s now.

The topics were thrust onto the national stage in October when news broke that Hollywood boss Harvey Weinstein had allegedly sexually harassed and abused dozens of women for decades, using his power in the industry to threaten their careers if they didn’t comply with his demands.

The sordid details of his reported manipulation clearly resonated, emboldening women to come forward with allegations against a string of other high-profile men in media, entertainment and politics — from Bill O’Reilly to Charlie Rose to Al Franken — and spawning the national #MeToo movement on social media.

This cultural shift has not been lost on corporate America, which is now revisiting many of its workplace policies.

This month, with relations between men and women in the workplace coming under heavy scrutiny, The Real Deal took a closer look at the dramatic gender divide in real estate, breaking down the male-to-female ratios at some of the industry’s biggest firms and dissecting how the power dynamics play out on the ground.

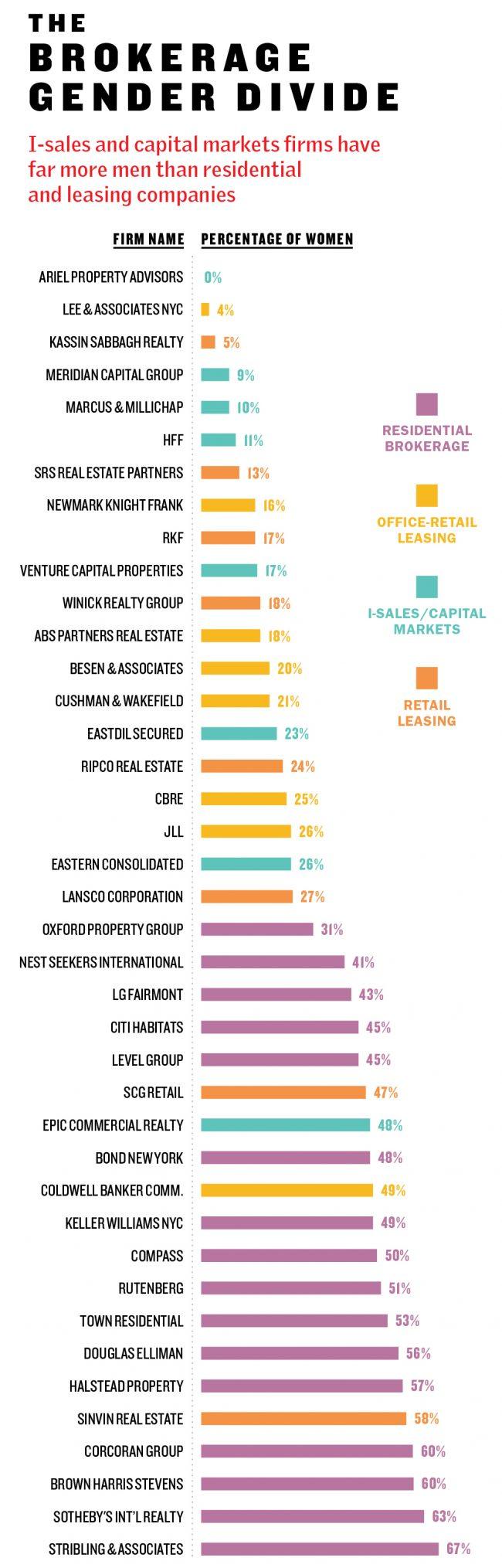

What we discovered is, on the one hand, not surprising: that the development and commercial sectors are dominated by men and that residential firms are more heavily tilted to women. But in commercial, there are more nuanced findings about the sectors in which women are best represented.

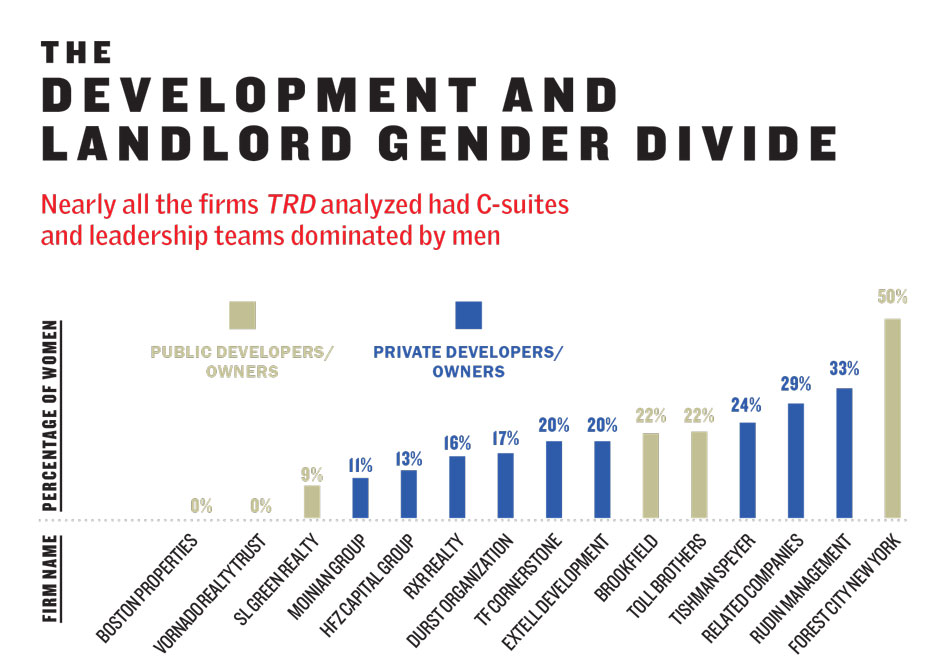

When it comes to New York City’s largest development and investment firms, most have leadership teams that are at least 70 percent male. Meanwhile, of the city’s 20 largest commercial brokerages, only three come close to having an even split of male and female brokers.

In addition, there was virtually zero improvement in gender diversity in real estate industry between 2007 and 2015, the most recent data from the U.S. Equal Employment Opportunity Commission shows. Women made up 27.2 percent of executive-level managers in the New York metro area in 2007 versus 27.3 percent in 2015. And there was a slightly smaller share of female midlevel managers in 2015, at 40.5 percent, than the 41.7 percent in 2007.

There isn’t one reason for the gender divide. Development firms and commercial brokerages — like many industries — have a long history of being controlled by men, and while women have certainly reached high-powered positions, they remain the exceptions. TRD spoke to a cross section of women in the industry about why the disparity persists: Some believe the glass ceiling is only there if you see it, while others contend that companies aren’t doing enough to seek out qualified women. What everyone seems to agree on, however, is that commercial brokerage and development is a high-stakes, cutthroat business that requires breaking into a tight-knit network that is largely unavailable to many women.

“People hire people that they know and people who look like them,” said developer Toby Moskovits. “[Commercial real estate] is a testosterone-laden environment. It’s hard as a woman in that world to find your place.”

Wanted: Estrogen injection

Wanted: Estrogen injection

Real estate is, of course, not alone in its maleness.

Hollywood, for one, has produced a minuscule number of female directors. Kathryn Bigelow, who directed “Zero Dark Thirty” and “Hurt Locker,” and Patty Jenkins, who made headlines for directing “Wonder Woman” last year, are the two poster cases. In 2017, only 21 out of 100 U.S. senators were women.

And that might be a better showing than New York’s commercial real estate industry.

The C-suites and top decision-makers are testosterone-filled. Of the 15 developers and owners with the largest NYC holdings based on square footage and dollar value, eight had one woman or none at all on their leadership teams.

Vornado Realty Trust, for instance, does not have a single woman among its top 16 executives — though Wendy Silverstein, now the CEO of New York REIT, was third in command there for years before departing in 2015. Meanwhile, SL Green Realty, another of NYC’s largest office landlords, has just one woman on its 11-person executive team. Both companies declined to comment for this story.

The situation is not much better for developers, which Moskovits perhaps knows better than anyone.

As construction lending slowed to a trickle and projects across the city came to a halt in the wake of the 2008 financial crisis, the then-31-year-old mother of three launched her own development firm.

“People were in suspended disbelief that this woman with no real estate experience had the wherewithal to close any deal,” Moskovits said.

But a decade later, Moskovits remains one of the few female developers in the city. And, she said, it took a time when many real estate firms were backing away from deals to level the playing field.

With a few exceptions, such as MaryAnne Gilmartin, the CEO of Forest City New York, the daughters of some New York real estate moguls are among the only women in leadership positions at development firms in the city. They include Laurie Zucker, Amy Rose, Andrea Olshan, Lisa Silverstein and Helena Durst.

A prominent family name can be a significant leg up for those on the commercial side, sources said.

CBRE’s investment sales powerhouse Darcy Stacom, a chair at the firm, said she kept her maiden name because it had more industry recognition (both her father and mother were brokers).

Olshan, who took over her eponymous development firm from her father, said she needs to work harder to prove that she deserves to be CEO — and that she’s not just there because her dad founded the company.

“Listen, I’m a 6-foot tall female CEO who is a second-generation,” she said. “There are 8 million reasons to hate me.”

Officials at one major development firm, RXR Realty, said its percentage of female senior executives has increased to “nearly 17 percent” from roughly 5 percent in a little over a year. The company also said 50 percent of its commercial leasing senior personnel are female, as are 20 percent of its construction division managers and 30 percent of its development division managers. And its COO of construction and development is a woman, Joanne Minieri.

Minieri acknowledged that the business has been “dominated by men” but said RXR has made a concerted effort to hire more diverse employees.

“Not only have the ranks of women among RXR’s senior-most executives increased several times over in the last two years, but the company now has a substantial and growing cohort of women in senior positions in functions in which women have historically not been well-represented in our industry,” she said.

In the commercial brokerage world — which some tout as more of a meritocracy than development, due to its commission-based structure — firms that focus on investment sales and debt have yet to make similar progress, while those that focus on retail leasing tend to be far more mixed.

At investment sales firm Ariel Property Advisors, for example, all 25 brokers are men, according to TRD’s analysis of state licensing numbers. Officials at the firm said their top priority is to hire the best candidate for the job.

“We did just hire [a woman], and we are actively looking to hire top talent regardless of gender and race,” said Paul McCormick, senior vice president, investment sales and capital services, who manages the sales team. “If it happened to be a woman, we are more than excited about that.”

Additionally, for the last four years, the firm has been offering internships to high-schoolers, including students at the private all-girls Chapin School.

Source: Residential and investment sales brokerages were included if they made TRD’s latest rankings, while leasing firms were selected through an analysis of CoStar Group data. Gender breakdowns for the brokerages were done through an analysis of brokers’ names downloaded from New York State Department of State’s licensing data and also vetted with the companies.

Meanwhile, at the debt and investment sales brokerage Meridian Capital Group, 120 of the 132 brokers are men.

And of Marcus & Millichap’s 170 brokers, 153 are men.

Susan Bands — a 13-year firm veteran who was recently promoted to sales manager in the investment sales division — could not pinpoint why investment sales attracts fewer women than leasing. But she said she generally receives few résumés from women, and those who do apply often have little sales experience.

And while there are a handful of star female commercial brokers — Stacom on the investment sales side, along with Mary Ann Tighe and Tara Stacom (Darcy’s sister) on the leasing side — the big brokerages are far from leading the charge on this issue.

At Cushman & Wakefield’s New York City office, the largest commercial brokerage in the city, 421 of the 530 brokers, or about 79 percent, are men, according to TRD’s analysis. At CBRE, 374 of the firm’s 497 brokers, or about 75 percent, are men.

James Wacht, president of commercial service firm Lee & Associates, readily acknowledged that his company doesn’t have many women. (The 57-person brokerage has two.) He said the decision-makers at the corporations his company deals with are invariably men — who are more likely to call up a buddy from college to find office space for their business than a woman they’ve never met.

“We’re really just a reflection of who we do business with,” he said. “You can be the smartest woman in the room, but if you don’t have the network you’re not going to succeed.”

‘Pathetic and outrageous’

The notion that companies don’t have to concern themselves with gender issues and can simply wait for others to act first does not sit well with some.

Deputy Mayor Alicia Glen called that approach “pathetic and outrageous.”

But Joel Nadler, associate of psychology at Southern Illinois University Edwardsville, whose research includes gender bias and behavior in organizations, said “similarity bias” feeds on itself.

“We like people who are like us,” Nadler said. “If we have three candidates who are all equal, and I’m a 50-year-old male making the hiring decisions, the candidate who is a 50-year-old white male automatically has an invisible plus one.”

Glen and many other women who spoke to TRD said real estate firms need to be more proactive in recruiting qualified women.

Marcus & Millichap’s Bands, who is actively involved in the company’s hiring, is looking to recruit women at both entry and senior levels. “I believe that women will attract more women,” she said. “What I really feel is that we need more female mentors.”

CBRE’s Tighe, CEO of the firm’s New York tri-state region, echoed that point.

“Many women find the atmosphere of commercial brokerage daunting,” she said. “Traditionally, it’s had the feeling of a boys’ club or a sports club. You need to have enough women in the management level for women to feel comfortable in a firm.”

Having a more even split can shape how a company operates. And the tipping point, at least according to the so-called critical mass theory — created by economist Thomas Schelling in the 1970s — is 30 percent, meaning that women must make up almost a third of the workforce to effect policy at a company.

Of the commercial brokerages that TRD analyzed, only three of the top 20 firms hit that mark: The 273-person Coldwell Banker Commercial is 49 percent female, while the little-known Soho-based firm Epic Commercial Realty, which has 21 brokers, is 48 percent female. And the exclusively retail Shopping Center Group, which has 19 brokers, is 47 percent female. (It should be said that despite that strong showing, the CEOs of all those companies are male).

“There have been many times where I’m one of 20 people in the room, and I’m the only woman,” said Caaminee Pandit, former vice president of acquisitions and development at the Criterion Group.

Pandit, who recently left Criterion and just accepted a position at Lendlease as a development manager, added: “It does have an impact.”

The gender makeup on the residential side of the business is decidedly more female.

Of the city’s 10 biggest residential brokerages, nine have workforces made up of at least 48 percent women (Oxford Property Group is 31 percent female).

At the city’s two largest residential brokerages, Douglas Elliman and the Corcoran Group, roughly 56 percent and 60 percent of the brokers are female, respectively. At Keller Williams, which is currently the third-largest firm by headcount, according to state licensing data, 49 percent of agents are women.

And Elliman and Corcoran both have female CEOs in Dottie Herman and Pam Liebman, as do four of the remaining 10 largest brokerages.

And Elliman and Corcoran both have female CEOs in Dottie Herman and Pam Liebman, as do four of the remaining 10 largest brokerages.

This sector has obviously long been more of a female stomping ground — a reality rooted in the fact that two or three decades ago it was viewed more as a part-time gig than as the more serious, multi-million-dollar business it is today.

“Many people came into this as a second career, or after having a family,” said Elizabeth Ann Stribling-Kivlan, whose mother founded Stribling & Associates in 1980. “No one in 1978 was graduating from college and saying, ‘I’m going into residential real estate.’”

She said part of the reason the industry has remained closer to gender parity is that it offers schedule flexibility.

“[My mother] never missed a lacrosse game,” said Stribling-Kivlan, now the firm’s president. “She had the flexibility to run an entire empire, and I never felt like I was missing a parent.”

Still, Bess Freedman, who was named co-president of Brown Harris Stevens in December, noted that with the exception of Stribling, the largest residential brokerages are still owned by men.

“It’s drip by drip for us to make progress,” said Freedman, who predicted that the commercial sector would eventually catch up. “We’re not even close to where we need to be.”

Breaking the ceiling

Commercial real estate, particularly development and investment, requires a stomach for enormous risk-taking — and a financial safety net is often a huge help.

“Commercial real estate is not for the fainthearted,” said Daun Paris, president and co-founder of the brokerage Eastern Consolidated.

Paris, who runs the firm with her husband, Peter Hauspurg, said that a disproportionate number of men apply for jobs, which she partially attributed to the fact that few colleges offer real estate as a major. Plus, she said, “societally, women are not encouraged to be independent, to be competitive or to be strong.”

Yet like others who’ve shattered the glass ceiling, she insisted that real estate is one of the few careers that allows women to rise based purely on merit.

Laurie Golub, who was recently named COO of real estate investment management firm Square Mile Capital, said the “glass ceiling is only there if you’re looking for it.” (Golub also served as general counsel and managing director of business affairs at Africa Israel and COO at HFZ Capital Group.)

Laurie Golub, who was recently named COO of real estate investment management firm Square Mile Capital, said the “glass ceiling is only there if you’re looking for it.” (Golub also served as general counsel and managing director of business affairs at Africa Israel and COO at HFZ Capital Group.)

CBRE’s Stacom said that once at the negotiation table for a complex deal, men have little reason to doubt their female counterparts. “Everything is numbers- and structure-based,” she said. “I know when I look at another woman in the room that she’s fully qualified to be in the room.”

Leslie Himmel, co-managing partner of Himmel + Meringoff Properties, had a similar assessment.

“I spend most of my time solving business problems and working on deals. I won’t allow myself into a book club conversation into what it’s like being a woman in business,” she said. “It doesn’t come up in my mind anymore.”

Mayday, payday

Still, women who’ve broken into commercial real estate are contending with a very real pay gap.

The industry’s median annual compensation was $115,000 for women and $150,000 for men, according to a 2015 national survey by the Commercial Real Estate Women Network. The average income gap was about 23 percent — and 30 percent in the C-suite, where it was most pronounced.

Surprisingly, men and women ask for raises with the same frequency, according to a 2016 Australian study released by Cass Business School in London, the University of Warwick and the University of Wisconsin-Oshkosh. But women don’t receive them as often.

“Women tend to be more reserved when negotiating their pay package,” said Wendy Cai-Lee, a former executive at East West Bank who recently launched her own investment firm, Oenus Capital. “In my experience, women do ask for raises and bonuses, but they are less aggressive. When told no, they don’t push back enough [and are] often too polite and sometimes apologetic for asking.”

But being assertive can be a “double-edged sword,” said Kim Elsesser, a researcher at the University of California who focuses on gender issues in the workplace.

“There is some evidence that when women do negotiate, they are perceived negatively for being too aggressive,” she said.

For those who have the connections, experience and financial resources, launching an independent firm can be a good alternative — but that isn’t an option for most. Cai-Lee said getting into the lending game was a good route for her.

“It was easier to get an audience when you are giving out money,” Cai-Lee said. “If I started out as someone who was trying to access pipelines or deals, it would’ve been more challenging.”

Of course, there’s also evidence of progress. CBRE’s Stacom said she rarely walks into a room expecting to be the only woman. For example, when CIM Group negotiated with New York REIT to buy 1440 Broadway in October, three women were leading the talks: Stacom, CIM’s Sondra Wenger and New York REIT’s Silverstein.

“I think there are a lot of great women who are trying to open up the field,” said Alicia Goldstein, senior managing director and president of sales and marketing at HFZ Capital. “There are more opportunities than there have been in the past.”

Real estate’s moment?

Real estate has yet to join the #MeToo movement in a meaningful way, but there are plenty of reasons to believe it will. CBRE’s Tighe said the industry is far from the “model of gender-neutral behavior.”

“We’re like all the other industries,” she said. “If you think of the stories that have circulated over the years, it’s inevitable that it’s going to happen.”

And even an equally divided workforce doesn’t come with guarantees. Case in point is Forest City New York, which is often touted as one of the only development firms with a strong pipeline of female leaders — 50 percent of the firm’s leadership team is female.

James Stuckey, who in the early aughts led Forest City’s massive Atlantic Yards project in Brooklyn (now called Pacific Park), was known for surrounding himself with hardworking, intelligent women. People would jokingly refer to the rotating group of female subordinates as “Jim’s harem.”

But in 2007, Stuckey quietly left the company, saying he was resigning for “personal reasons and a desire to pursue new challenges.” Shortly after his departure, he was named divisional dean of the New York University’s Schack Institute of Real Estate. Four years later, Stuckey resigned from the post for “health reasons.”

Source: TRD selected developers and owners based on an analysis of size of their NYC real estate holdings by square feet and dollar value. Their gender breakdowns were determined by reviewing individuals on each company’s website and vetting those numbers with the firms. Only C-Suite and management teams were included.

But a year later, in 2012, former NYU colleague Stephanie Bonadio sued him, alleging that he “forcibly placed her hand on his crotch and his erect penis” during a dinner that was arranged to discuss a possible promotion. The lawsuit disclosed that several women at Forest City had also accused him of sexual harassment. The New York Post reported that at a 2006 Christmas party, Stuckey called five of his female subordinates into a room and instructed them to sit on his lap.

In a draft complaint that was intended to be filed with the EEOC in 2007, one of the Forest City employees said Stuckey rubbed her leg and told her that she would go far in the company. Another woman alleged that she repeatedly reported inappropriate comments Stuckey made about her body.

Other executives at the company responded by pointing out that Stuckey was “an important person,” or that his behavior was something that they’d get used to, according to the complaint, which was provided to TRD by an anonymous source. The case was ultimately settled before being filed with the EEOC. Bonadio’s lawsuit was also quietly settled in 2016. The attorney for both Bonadio’s complaint and the pre-EEOC filing — Kathleen Peratis, a partner at Outten & Golden — declined to comment, while Stuckey did not respond to multiple requests for comment.

Ashley Cotton, a spokesperson for Forest City New York, said in a statement that the firm has “zero tolerance for gender discrimination or sexual harassment of any kind.”

Cotton maintained that “when allegations surfaced we undertook a thorough investigation that led to the removal of Mr. Stuckey from his position more than 10 years ago.”

“Forest City continues to implement stringent policies that reflect our commitment to diversity and industry-leading record of female leadership,” she added.

Hush money

The Stuckey settlement is anything but unique. Hush money abounds in virtually every industry.

In one of the most extreme cases, Fox News reportedly settled a $32 million sexual harassment claim against O’Reilly in January.

Sources say misconduct cases in NYC real estate, as in other industries, often get settled before ever seeing the light of day. And those settlements come with strict nondisclosure agreements that prevent victims from publicly speaking out.

Others become public only when a lawsuit is filed, but are then settled before going to trial.

Such was the case with a recent suit against Elliman broker Jared Seligman.

In May, Seligman’s personal assistant filed a complaint alleging that she was required to work out of her boss’ apartment while he had “loud and unmistakable sexual intercourse” in an adjacent bedroom. He then allegedly emerged from his room wearing nothing but his bathrobe. On another occasion, she claimed Seligman groped his doctor, who was administering Botox injections. Seligman settled the case for $136,000, according to an Oct. 30 letter to the court.

In May, Seligman’s personal assistant filed a complaint alleging that she was required to work out of her boss’ apartment while he had “loud and unmistakable sexual intercourse” in an adjacent bedroom. He then allegedly emerged from his room wearing nothing but his bathrobe. On another occasion, she claimed Seligman groped his doctor, who was administering Botox injections. Seligman settled the case for $136,000, according to an Oct. 30 letter to the court.

When reached in December, Seligman said only: “I do not comment on litigation matters other than I deny the allegations that were made in the proceeding. That said, I’m delighted that the matter is resolved and to have it behind me.”

Charles Joseph, a partner at the law firm Joseph & Kirschenbaum, which specializes in discrimination and harassment lawsuits, said companies — especially small ones — often settle to avoid litigation costs and unwanted publicity.

In another case, residential broker Andrea Sedwick sued her boss at Nest Seekers International, Ravi Gulivindala, for allegedly pressuring her into a two-and-a-half-year relationship that turned abusive. According to the 2015 complaint, Gulivindala repeatedly tried to kiss and touch Sedwick at social events. Though she said she tried to avoid him, he fed her more client leads than he was giving other agents.

The “plaintiff understood this to mean that Gulivindala would enhance her career at Nest Seekers if she relented to his overtures,” according to the complaint.

While the two were dating, Sedwick alleged that Gulivindala became physically abusive. After Sedwick broke off the relationship, Gulivindala cut off her access to the brokerage’s computer system, according to the complaint. The lawsuit was settled for an undisclosed amount in February 2017, and Sedwick left Nest Seekers.

While those cases may be extreme, female sources said they often find themselves in uncomfortable business situations.

One woman, who asked to go unnamed, told TRD that male colleagues have jokingly invited her to strip clubs for client meetings. This isn’t to say every handshake deal is done between table dances, but it happens.

Corcoran’s Liebman said she’s heard of “extracurricular activities” in real estate, though she declined to elaborate.

“I’ve heard of celebrations being had at all sorts of venues where a woman may not feel welcome,” Liebman said, noting that she expects there will be less of that going forward, given the series of harassment cases in other industries.

“This was a game-changer year for this,” she said. “This has empowered women all over to take a stand.”

But the University of California’s Elsesser said the deluge of recent sexual harassment allegations could further sideline women in business by making men too wary to even engage — in part because there needs to be more discussion about what exactly qualifies as sexual harassment.

“Six months ago, it was really hard for a woman to go out for a drink,” she said. “Now it’s going to be even harder for women to make those necessary relationships.”

Paying for diversity

One key problem for real estate firms is that changing hiring practices can be expensive.

As a result, sources say, large, deep-pocketed corporations often have an easier time launching initiatives to diversify their workforces.

“It is really easy to find and hire white men at the senior level,” said one senior-level woman at a New York City-based private equity firm, who was not authorized by her company to speak on the record. “But there are really talented women and people of color out there.”

Women of color, in fact, face something of a double-jeopardy situation when it comes to getting hired, as TRD reported in a cover story about the industry’s overarching diversity problem last year. The Wall Street Journal described the obstacles that minority women in business face as a “concrete ceiling” instead of a glass one.

“Fortunately, in the big picture, diversity does pay off,” said Nadler of Southern Illinois University Edwardsville. “Usually the company that does take the initial hits will begin to expand their customer base.”

Melissa Gliatta, COO of Thor Equities, said that offering job flexibility is also key.

Gliatta said that after having her second child in 1998, she felt overwhelmed and went to her boss, Joseph Sitt, who told her that she could work part-time for as long as she needed and then return to full-time. She was too important to lose, he said.

“Something like that meant the world to me,” she said. “For me, I took one step back working part-time, and then took six steps forward.”

On the most basic level, it’s also crucial that companies start recognizing that dramatic change isn’t going to happen organically, said Glen, the deputy mayor.

“There’s a degree of going into battle in this,” she said. “It starts with consciously hiring more women. If you get a pile of résumés and there aren’t many women, throw out the pile and get a new pile.”

— Lead research by Ashley McHugh-Chiappone

—Additional research by Adam Pincus and Lucas McGill

Update: This article has been updated to include the gender breakdown for Compass.