While real estate and construction remained the most impacted sectors in India in H1FY21, there was some buoyancy during H2FY21, with the economic activity reviving. Measures such as a reduction in the stamp duty in Maharashtra, lower interest rates, pent up demand and a halt in launches provided some relief to the realty sector. However, the green shoots that had started becoming visible were short-lived as the second wave of the pandemic hit the nation unawares and much harder, according to a research report by Brickwork Ratings.

Owing to the accelerated vaccine programme adopted by the government, it is now subsiding, and hopefully the problems inflicted by the pandemic should subside soon. While Q1FY22 is expected to be a near washout for most real estate players, the pace of sales is expected to gain traction in the remaining part of FY22, with launches by various marquee players. Increased discounts, freebies and attractive/flexible payment terms in addition to benign interest rates and regulatory measures are expected to boost sales for real estate players, albeit only H2FY22 onwards. A key role here, expectedly, is going to be played by the affordable housing space.

Residential real estate has been facing challenges for some time now and is expected to see some traction going forward. With the extension of the work-from-home and online education culture, there is an increased need for larger homes, especially for families with working couples. Residential project sales, which had picked up towards end-Q2FY21, only to slow down in April and May 2021, are expected to witness recovery from the lower base recorded in H1FY21.

While negative sentiments led to reduced discretionary spending, resulting in the postponement of buying decisions, the need for safer and bigger homes could actually result in increased demand for residential real estate. The sector is also expected to witness increased home buying from the final/end user rather than investors. Additionally, with prolonged work-from-home for corporate employees, some reverse migration towards tier-2 and tier-3 cities is expected, which may lead to real estate demand gaining traction in these cities.

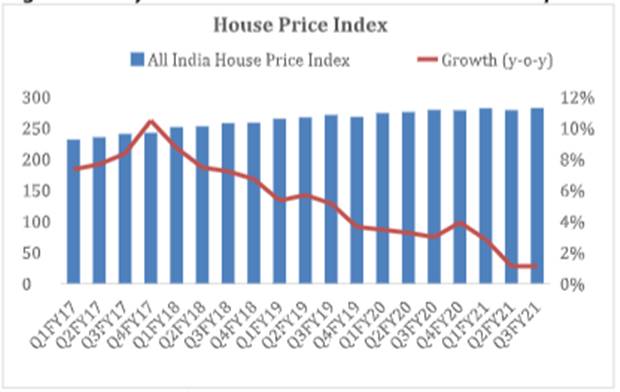

Notwithstanding the gradual increase in home loans outstanding for banks since FY17, the y-o-y growth rate has seen a declining trend since FY20, partially owing to a weak buyers’ sentiment due to the economic slowdown, followed by the pandemic impact. The same trend was observed in the house price index. However, concerns around weak demand and high inventory levels were offset by renewed interest in the sector from FPIs due to the low interest rate regime and expectations of a near-term revival.

High inventory levels and lacklustre demand resulted in prices stagnating

Source: RBI, BWR Research

Commercial real estate, which was performing well over the years, has come under tremendous stress during the pandemic. It has been witnessing high vacancies and the waiver of lease rentals, which is expected to continue till H1FY22 due to oversupply of office spaces, which is further compounded by numerous expired leases coming up for renewals. For the ailing commercial real estate sector, the antidote (literally) is the vaccine, and the pace at which vaccine administration is accelerated. With this, demand for commercial spaces would hopefully revive, and developers are also expected to witness demand for redesigning/re-doing spaces to meet the increased hygiene- and safety-related norms in the new normal.

One aspect of this segment that could gain momentum is the concept of co-working spaces. This, while saving higher upfront capital expenditures and fixed costs, also results in longer lease terms with a lock-in period agreeable to both the lessor and lessee. Another sub-segment of commercial real estate, hospitality, is the worst hit; recovery, while slow, will largely depend on the resumption of tourism activities in the country, especially on the commencement of international travel.

In terms of investments and fund raising in the real estate sector, foreign portfolio investors’ assets under custody increased y-o-y by 103% to Rs 41,476 crore in March 2021. Improving investor sentiments were reflected in declining inventories in tier-1 cities. There has been an active participation in the Real Estate Investment Trust (REIT) issuances, with three REITs getting listed in the last two years, and Rs 13,000 crore have been raised cumulatively. It has received a good response from investors, and more such issuances are expected going forward.

Given the decrease in Covid-19 cases and the overall expectation of the second wave subsiding soon, the overall macro environment is expected to remain strong, supported by stable (and improved) demand in an era of the lowest interest rates ever witnessed in India. While pent up demand has helped keep the sector afloat amid the pandemic, the launches lined up by real estate developers would actually offer the support required for providing momentum for revival.