Dealpath Streamlines Deal Management for CRE Industry

CREtech Blog

"Commercial real estate is a massive industry and a critical business function that has been vastly underserved from a technology standpoint," said Michael Sroka, CEO of Dealpath. "With so much at stake, it`s important that the processes behind investment and acquisition run as smoothly as possible."

Dealpath was purpose-built for workflow management in the CRE industry. Its goal is for organize information and simplify team collaboration to better track deals and investment decisions.

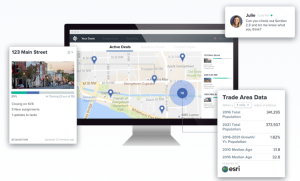

The intelligent collaboration platform allows for work distribution, tracking receivables, and property acquisition. The system is designed with a consumer mindset, meaning set up is accomplished in minutes, not hours or days. It is compatible with other data services like Google, Dropbox, Outlook and Yardi. In-built system transparency makes accountability for tasks easy to track and files instantly searchable. Users can access Dealpath from anywhere since CRE professionals spend more time on site than in an office.

Sroka said it was time to move multi-million dollar transactions away from using Word, Excel, and basic checklists emailed back and forth. "At Dealpath we have made it our mission to provide CRE deal teams with the tools, resources, and information they need to create and capture value."

RCREF Managing Director Bill Frazer finds that Dealpath has done just that. "From sourcing and underwriting through diligence, closing and beyond, Dealpath puts the information I need at my fingertips. It`s a very powerful platform delivered through an interface that teams want to use."

Top venture firms and industry operators contributed to the $8 million in Series A financing supporting Dealpath`s launch, including Milstein, LeFrak, and Formation8.

"Multi-billion commercial real estate enterprises are using and impressed by the Dealpath platform," said Joe Lonsdale from Formation 8, who led the Series A financing. "The business and approach aligns closely with our view of the world and we`re very bullish about the opportunity."

More than 100 firms currently use Dealpath to streamline their processes. The companies range from industry leaders such as Millennium Partners to specialized CRE firms like U.S. Restaurant Properties.