RealtyShares Offers Expanded Opportunity to Invest in Real Estate

CREtech Blog

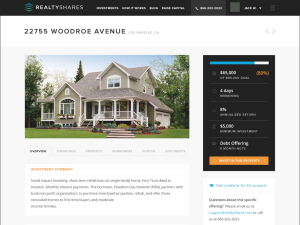

In recent years, crowdfunding has become the new way to raise capital for everything from charitable fundraisers to startups. Now, crowdfunding has evolved to include real estate investing, and RealtyShares is making it easier for would-be investors to get involved. With crowdfunding opportunities like RealtyShares, it is possible for developers to raise capital by leveraging the power of smaller investors in an automated, secure manner.

Only a year old, RealtyShares began as a way for investors to put small amounts of money into real estate-related projects. Since then, RealtyShares has continued to grow and is now expanding by making it possible to invest in specific markets in the United States.

How RealtyShares Works

With RealtyShares, investors can get started with only $5,000 and invest in a variety of different projects, including multifamily homes, single-family homes, and even commercial real estate. Considering the fact that these projects can cost hundreds of thousands and even tens of millions of dollars, RealtyShares is providing a true value by giving everyday investors the opportunity to get involved in projects in which they would typically never even have dreamed of being able to invest.

With RealtyShares, investors can get started with only $5,000 and invest in a variety of different projects, including multifamily homes, single-family homes, and even commercial real estate. Considering the fact that these projects can cost hundreds of thousands and even tens of millions of dollars, RealtyShares is providing a true value by giving everyday investors the opportunity to get involved in projects in which they would typically never even have dreamed of being able to invest.

RealtyShares is beneficial not only for real estate investors, but also for developers. With RealtyShares, developers can take advantage of the opportunity to raise funds for their projects quickly and easily. On average, RealtyShares funds nearly two dozen projects on a monthly basis and is able to fund each of those projects within just a few days. Compared to the fact that it can take months for a project to be funded using more traditional options, that is certainly an advantage that should not be taken lightly.

Recently, RealtyShares announced that it plans to connect investors and borrowers in five specific markets in which it sees potential. Those markets are Dallas, Seattle, Chicago, Miami, and Austin. By offering more market specific investment opportunities, RealtyShares offers developers the opportunity to locate funding on a local level. This can also prove to be advantageous for investors, because it offers the chance to invest in a project that is closer to home rather than far flung.

Naturally, investors want to check up on their investments from time to time, and this is one area where RealtyShares exceeds. Using an investor dashboard, investors can monitor their investments as well as their returns.

The Bottom Line — Is RealtyShares Worth It

Does RealtyShares have any downsides? If so, it is that it has only been in business since 2013, and, as a result, does not have a long history. Of course, that is not that uncommon in today’s world of rapidly evolving crowdfunding sites.

Considering that RealtyShares has received a tremendous amount of media attention within its short history and seems to be growing rapidly, it appears to be a good choice if you’re interested in either raising funds for your project or purchasing shares in a real estate project.