Redfin Introduces New Housing Market Index

CREtech Blog

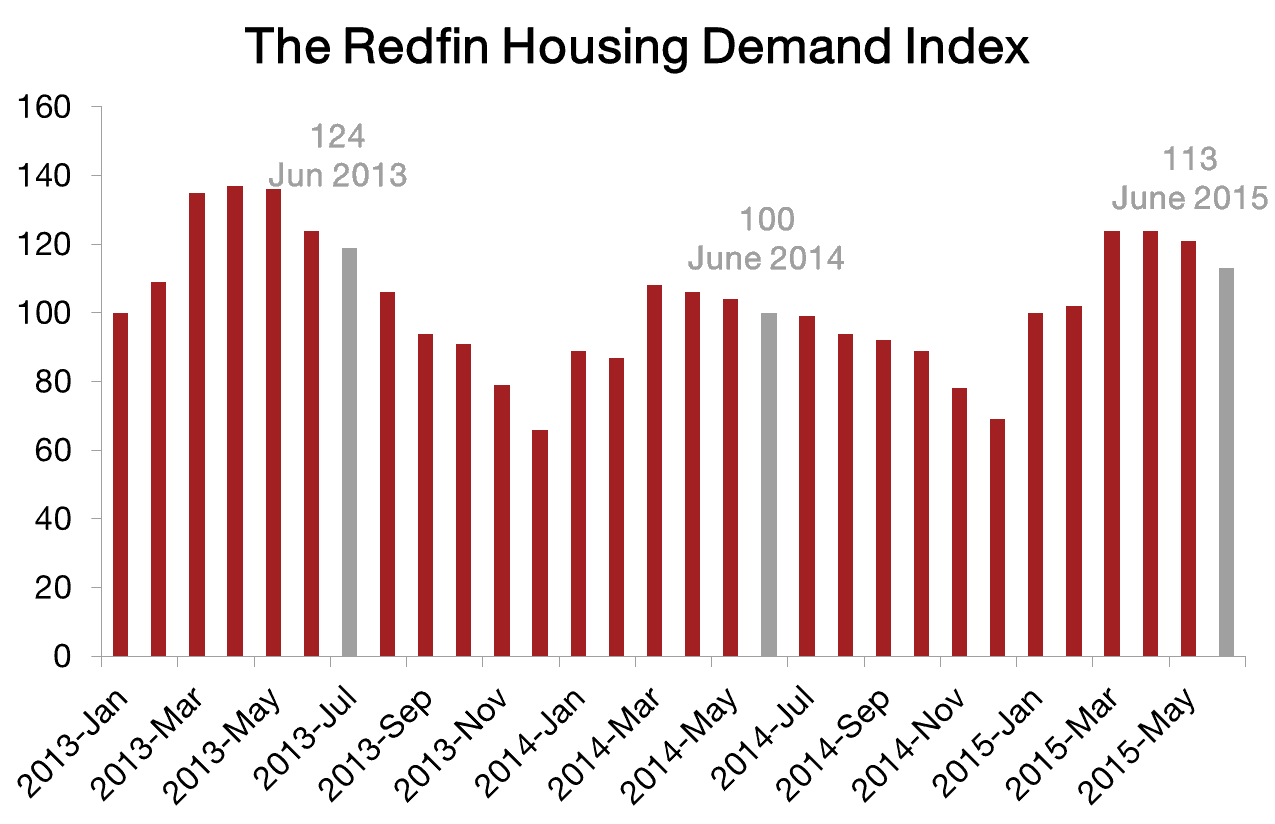

Redfin, which has become known throughout the real estate industry for its groundbreaking real estate brokerage services, has recently announced the debut of its Housing Demand Index. According to that Index, housing market performance has increased 13 percent year-over-year since June. The Index has a baseline of 100.

Earlier in the year, the Housing Demand Index demonstrated a seasonal pattern, showing an increase between January and April. The Index is based on visits to Redfin.com listing pages as well as requests for home tours from Redfin customers.

Forecasting the Future of Real Estate Transactions

Redfin utilizes demand data from 15 metro areas around the country in order to make forecast predictions regarding changes in year-over-year home prices and sales. According to Redfin, home prices are anticipated to increase by about 4.3 percent this month. Overall, Redfin has predicted that the number of homes sold will increase by 14.3 percent year-over-year.

The firm has been quick to point out that the traditional seasonal slowdown this year has been greater than usual, primarily due to buyer fatigue resulting from low selection and high prices. Gradually increasing mortgage rates have also played a role in the slowdown. With that said, buyers are still actively participating in the market; however, they have begun to set limits on what they are willing to pay for home prices.

Due to greater price sensitivity, particularly in markets like Washington, D.C., homebuyers are continuing to tour homes, but fewer buyers are making offers. Those that do make offers are now showing a tendency toward purchasing less expensive homes.

Background on the Housing Demand Index

Redfin's Housing Demand Index became the first and only of its kind in the industry for measuring housing activity prior to purchases. The first month of the estimation period began in January 2013. Homebuyer activity is utilized by Redfin to forecast both medial sales volume and sales prices two months into the future, which translates to 30 to 60 days prior to final closings and property transfers being entered into public records. Currently, Redfin is the only major real estate brokerage to track almost all customer events within a single database.

The firm is continuing to work diligently toward improving the accuracy of sales and price forecasts. Currently, the Housing Demand Index only tracks 15 major metro areas; however, Redfin has expanded to serve more than 60 markets across the country. The Index covers the following major metro areas:

- Atlanta, GA

- Austin, TX

- Baltimore, MD

- Boston, MA

- Chicago, IL

- Denver, CO

- Los Angeles, CA

- Oakland, CA

- Orange County, CA

- Phoenix, AZ

- Portland, OR

- San Diego, CA

- San Francisco, CA

- Seattle, WA

- Washington, DC

What the Housing Slowdown Means for the Future

With housing demand apparently cooling in the coming months, home sellers may find that they will need to be more to negotiate regarding prices and concessions. The slowdown could also represent an excellent opportunity for investors, as sellers may be forced to contend with a smaller pool of willing buyers.

Related: Redfin: Atlanta among best places for Technology-Assisted Living