News Archives | Page 111 of 1033 | CREtech

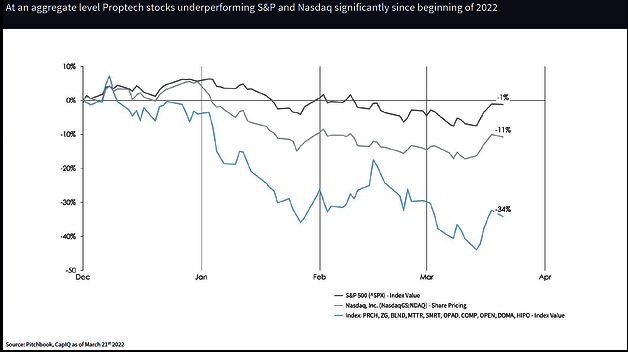

In April, First American Chief Innovation Officer Paul Hurst participated in a panel discussion at Inman Connect in New York, discussing the shifting capital environment for public and private proptech companies. Hurst offers some highlights from the panel discussion, discusses what the re-rating of proptech valuations means for the pace of real estate innovation in 2022, and shares insights from ...

Industrious, a provider of flexible workspaces that’s backed by CBRE Group Inc., acquired Great Room Offices and Welkin & Meraki to expand its footprint in Asia and Europe.

Route Konnect, a Cardiff-based AI software company, has picked up $1 million in a pre-seed equity investment round, which was led by the Development Bank of Wales’ Technology Seed Fund. also, additional investment came from proptech VC Pi Labs, early-stage investors SFC Capital and private angel investors with the backing of Plug and Play, the early investors in Dropbox and PayPal.

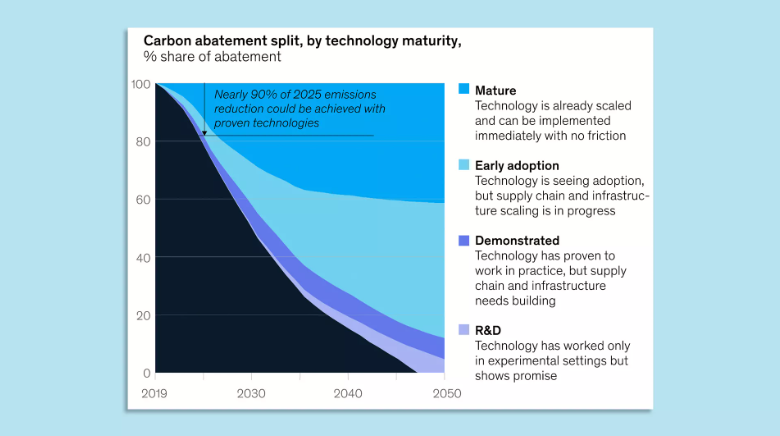

One thing that jumps out in McKinsey's look at a path to meeting U.S. climate targets is how much is feasible now with existing tech, Ben writes.

When tenants sign a lease, they trust the building’s management to maintain the property’s critical infrastructure. Electrical, heating, ventilation, water supply: these systems are mission-critical. Their failure can temporarily shut down a building, causing inconveniences and financial losses for occupying tenants. In some instances, the impact can be catastrophic.

Protecting such systems f...

A lot of founders ask, “When is the right time to take on venture capital investors?” The specific answer to this varies by company, but I’m always sure to remind them that as soon as they take VC money, the clock starts ticking.

A magnitudinous confluence of the corporate return-to-work push, supply chain issues that appear to be worsening, rising interest rates and the realization that office space needs to be recently built or updated to be competitive is fueling a historic surge in renovations.

Real estate has historically been a relatively safe haven for investment dollars—you buy, you live, you gain. Online real-estate platforms have held tight to this narrative amid a turbulent equity market, shaken first by a global pandemic and now by what seems to be a macroeconomic downturn. Should you believe them?

Dan Drogman, CEO of Smart Spaces, and Ella Walter, innovation manager at GPE, discuss how GPE is approaching innovation and embracing technology in commercial real estate.

During the worst days of the pandemic, when people were stuck at home and starving for some form of entertainment beyond streaming yet another TV series, many turned to DIY home improvement projects. With the home now a place for work, school and leisure all at once, the DIY home improvement market has grown so significantly that globally, it’s expected to reach $514.9 billion by 2028-end, up fr...