Seattle startup Flexe raised an additional $10 million as part of its Series C funding round announced in December. Flexe CEO Karl Siebrecht said there was more inves...

Capital Markets Archives | Page 36 of 58 | CREtech

The Los Angeles-based firm said in a regulatory filing that it will issue 25 million shares of its new special purpose acquisition company at $10 per share. Goldman Sachs and Deutsche Bank are underwriting the deal.

Funding for startups and growth-stage private companies in North America held up at historically high levels last year. Even amid a pandemic, widespread unemployment, and escalating small-business closures, investment was up year over year across all stages from early and beyond.

Back by popular demand, CREtech is proud to present our second virtual networking event, CREtech Venture Match, connecting investors and real estate technology companies for a series of 1:1 video meetings. Join us to forge new relationships and drive investment within the industry.

Hennessy Capital Investment Corp. V (the “Company”) announced today that it priced its upsized initial public offering of 30,000,000 units at $10.00 per unit. The units will be listed on The Nasdaq Capital Market (“Nasdaq”) and trade under the ticker symbol “HCICU” beginning tomorrow, Friday, January 15, 2021. Each unit consists of one share of the Company’s Class A common stock and ...

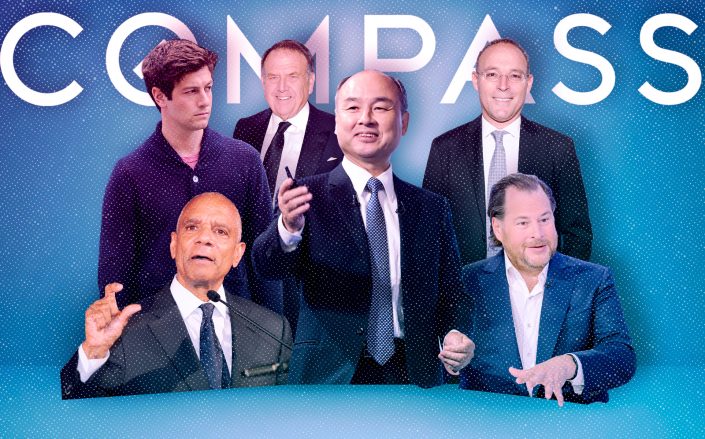

That group includes late-stage backers SoftBank Group, Wellington Management and Dragoneer. It also includes Joshua Kushner's Thrive Capital, Salesforce CEO Marc Benioff and American Express CEO Kenneth Chenault, who invested in Compass' early funding rounds, along with industry players Miki Naftali and LeFrak.

The LEX marketplace lets both accredited and unaccredited investors obtain minority positions in commercial real estate properties through single-asset IPOs, according to the company. Investors can buy and sell shares of commercial real estate assets without lockups through LEX’s platform, which is powered by Nasdaq.

The residential brokerage, which has raised $1.5 billion from investors including SoftBank, said it submitted a draft registration statement with the U.S. Securities and Exchange Commission on Monday. Compass did not disclose the size of the offering. The firm’s last valuation was $6.4 billion in July 2019, when it raised a $370 million Series G.

CF Acquisition V, the fifth blank check company formed by Cantor Fitzgerald, filed on Friday with the SEC to raise up to $250 million in an initial public offering. The New York, NY-based company plans to raise $250 million by offering 25 million units at $10. Each unit consists of one share of common stock and one-third of a warrant, exercisable at $11.50. The company may raise an additional $10 ...