In this rare interview, Michael and Brendan will discuss Fifth Wall’s history and the evolution of its model, including its focus on Climate Technology. A large part of the discussion will also encompass Fifth Wall and CREtech’s climate tech initiative, CREtech Climate. The live Webinar ...

Capital Markets Archives | Page 37 of 58 | CREtech

Fifth Wall, a Los Angeles-based proptech investor, is forming a special purpose acquisition company, or blank check company, to expand its presence in that sector, Bloomberg reports. The size of the SPAC hasn't been made public...

Fifth Wall, a Los Angeles-based venture firm, is planning to raise capital through a special purpose acquisition company, a sign that the momentum behind a vehicle that became mainstream in 2020 has continued into the new year.

...

This past fall, Henry M. Paulson Jr., the former Treasury secretary, got a call from Paul David Hewson, better known as Bono. The musician-activist-investor had an idea and “an ask”: Bono, who helped found TPG’s $5 billion Rise funds focused on “impact investing,” told Mr. Paulson that the investment firm wanted to create an even bigger platform to focus ex...

Venture capitalists have been historically reluctant to invest in startups based too far from home, thus making it it easier for "good ideas" to get funded in the Bay Area or the Acela corridor than anywhere else. 2020 may have finally changed that dynamic.

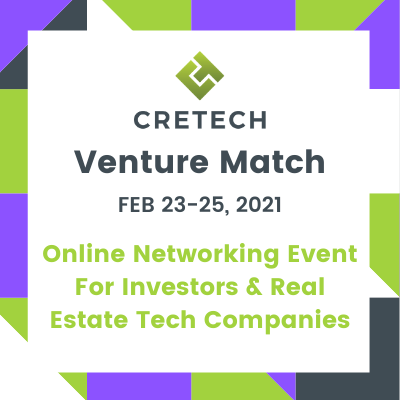

Back by popular demand, CREtech is proud to present our second virtual networking event, CREtech Venture Match, connecting investors and real estate technology companies for a series of 1:1 video meetings. Join us to forge new relationships and drive investment within the industry.

VergeSense, a startup that uses machine vision to help businesses better understand how their office spaces are being utilized, today announced that it has raised a $12 million Series B funding round led by Tola Capital.

Some got bailouts, others got boosters — but across the board, proptech firms continued to reel in cash in 2020 as the pandemic forced the slow-to-adapt real estate industry to fully embrace technology.

Qualia, a San Francisco, CA-based digital real estate closing technology company, raised $65m in Series D financing. The round, which increased its total funding to $160m and valued the company at over $1 billion, was led by existing investor Tiger Global, alongside other existing investors 8VC a...

Even before Opendoor’s official stock market debut on Dec. 21, the iBuyer’s valuation soared to nearly $18 billion as Wall Street investors cheered its merger with a special purpose acquisition company. Shares of Chamath Palipatihiya’s blank-check company more than tripled Friday after it completed the merger with Opendoor.